Telecommunications carriers in the US are in a "three-way" situation What are each company's 5G deployment and growth strategies?

Currently, the three telecommunication carriers in the United States are Verizon, AT&T, and T-Mobile, which account for more than 90% of the contract share.

In the midst of this, Shigeyuki Kishida, senior chief researcher at the Information and Communications Research Laboratory (ICR), explains, "In 5G deployment, competition is progressing in the low-frequency band."

Mr. Shigeyuki Kishida, Senior Chief Researcher, Information and Communications Research Laboratory

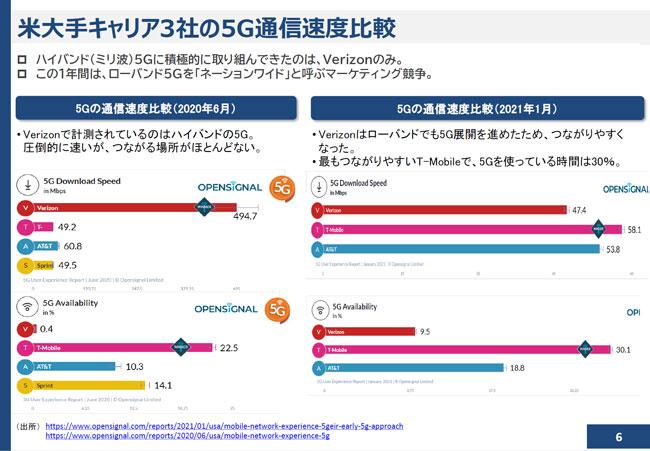

Initially, Verizon was rolling out 5G in the high band (millimeter wave band). However, although the speed was overwhelmingly fast, it was difficult to expand the area due to the characteristics of millimeter waves. Among them, T-Mobile will roll out low-band 5G, which is relatively easy to expand, nationwide, and will be the top in terms of ease of 5G connection. Inevitably, Verizon also launched low-band 5G, and although the time to catch 5G radio waves has increased, the speed is not high.

Although the availability (here, the percentage of time that grabs 5G) has improved, the speed is around 50-60 Mbps.

Since the speed is below 4G/LTE, Mr. Kishida points out that "5G in the United States is currently nothing more than a marketing competition, and the actual usage scene has not changed at all." Of course, careers don't stay that way forever. What is going on now is to acquire the mid-band, which has just the right communication speed and ease of connection, between the narrow area of the high band and the slow speed of the low band. T-Mobile owns a lot of the 2.5GHz spectrum through its merger with Sprint, but the mid-band that Verizon and AT&T currently own is already in use by LTE users, so they need to acquire new spectrum. There is Verizon spent $45.4 billion and AT&T $23.4 billion in a C-band (6GHz) frequency auction in February. In this way, we are strengthening the foundation of 5G for smartphones, but in what areas and how are each company trying to grow its business? “Actually, the growth strategies of the three companies are quite different,” says Kishida. Verizon Focuses on Telecoms Verizon is said to be focusing on its efforts in the telecoms space. The first is to enter the fixed wireless broadband market. Since 2018, we have been providing a high-band fixed wireless broadband service "5G Home" in a limited area, and we are considering expanding the deployment city. In the future, it will also target small and medium-sized enterprises. "In the United States, CATV operators are the strongest in fixed broadband. The situation is quite different from Japan, where fixed-line operators have an overwhelming market share in each region," says Mr. Kishida. The idea is to steal the market from this CATV operator. Efforts on MEC (Mobile Edge Computing) are also progressing, and in partnership with Amazon Web Service (AWS), "5G Edge" is provided as a set with 5G. The company's CEO said it expects to start monetizing in 2022.Working with AWS to provide MEC service "5G Edge" (*Part of the material has been edited)

In addition, Verizon plans to install an image processing function in MEC, and has introduced NVIDIA's GPU in earnest and is proceeding with development. Games are a specific use case. PC games, which are gaining popularity now, require a graphics card to be installed in the gaming PC for high-definition image rendering. However, if you use Verizon's MEC, you can play the same game from a smartphone instead of a high-spec PC with a graphics card. In addition, although it is actively developing corporate solutions, it is also focusing on acquiring MVNOs and launching sub-brands, as it can be expected to grow in the future.

![10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book] 10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/4a18d0792cae58836b71b9f591325261_0.jpeg)

![[Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc. [Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc.](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/c88341f90bab7fe3ce1dc78d8bd6b02d_0.jpeg)