The necessity and submission method of depreciation assets declaration form

What is a depreciated asset return? Explain the meaning of depreciated assets and the method of declaration as the enterprise object

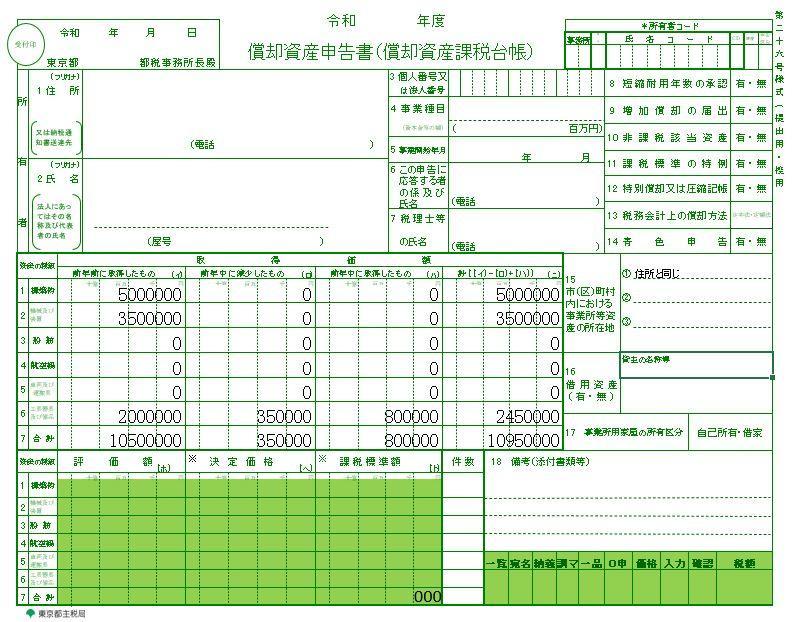

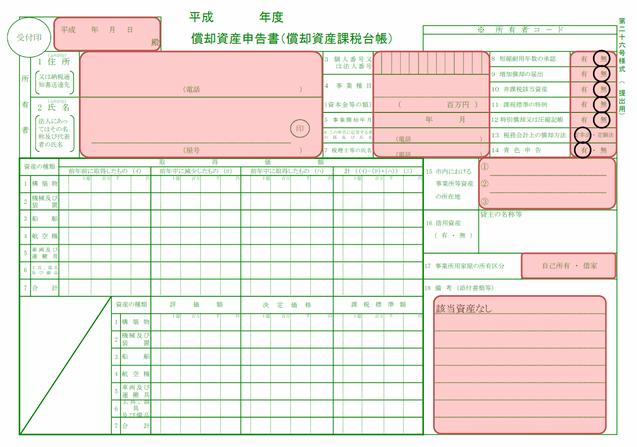

A depreciation asset return is a document required to hold taxable fixed assets. Related to the calculation of depreciation asset tax, documentation requires a variety of preparations.

納税のために必要な書類であるため、正しい知識を身に付けておかなければいけません。自社の資産のうち、どれが償却資産にあたるか正しく理解し、期限内にきちんと申告して納付書を受け取りましょう。例外的なケースもあるため、自社が特殊な状況にあるかどうかも確認してください。

In the Entrepreneurship Handbook where I wrote this article, more substantial information is also explained in the thick printed version of the Entrepreneurship Handbook. Because you can get it for free, please bring it over and have a look.

The catalogue of this article

What is a depreciated asset return?

What is a depreciated asset return?、減価償却資産の価値を申告し、償却資産税の金額を算出するための書類です。償却資産とは、会社や事業を行っている個人が持っている、事業に使う機械や設備などのことを指します。自社にどれだけの償却資産があるか報告して、課税金額を決めてもらうための書類が償却資産申告書です。

Depreciation assets tax is similar to fixed assets tax, but the object is different, and the process of paying tax is also different. In order to understand the amortized asset declaration, you also need to understand the process of calculating the amortized asset tax.

Depreciation assets tax is a local tax

Depreciation assets tax is the same local tax as fixed assets tax. Fixed assets tax is a municipal tax levied on people who own land and buildings. Generally speaking, you may give people an image related to buying land, building a house, and so on. However, the fixed assets tax includes not only land and buildings, but also depreciated assets known as depreciated assets.

固定資産税の一種

In the fixed assets tax, the part of depreciated assets is called depreciation asset tax. It is classified as a tax on assets, which is taxed on assets held by individuals or legal persons.

However, the formulation of fixed assets tax and amortized assets tax is different. Fixed assets tax does not calculate the amount of tax according to the procedures such as filling in or submitting declaration forms.

However, depreciation assets tax must be declared by operators and individual owners themselves. The reason for this is that assets such as machinery and equipment do not have a system in which owners can be controlled through a registration system like land and buildings. Even if the land and buildings are not declared, they can grasp the taxpayers and their value, but if the machinery and equipment are not declared, we do not know who has how much to levy. Therefore, fixed assets need not be declared, and depreciation assets tax needs to be declared.

固定資産の要件

Fixed assets refer to those held for non-sales purposes, used for more than one year, or more than a certain amount. As a specific amount, more than 200000 yen is generally counted as fixed assets. In addition, assets of less than 200000 yen and more than 100000 yen are treated as one-time depreciation assets, and those under 300000 yen are treated as small depreciation assets.

From the above conditions, something over 200000 yen is treated as an asset, and if it is less than 100000 yen, it cannot become an asset if it meets the other two conditions. Less than 100000 yen is basically treated not as an asset but as an expense.

Register of amortized assets

After submitting the depreciation asset declaration form, the municipal village will calculate the valuation and the actual tax paid on the basis of the declaration form and survey. After the decision on the valuation of the declared depreciated assets, it shall be registered as a tax account for the depreciated assets. The prices registered in the tax account of depreciated assets can also be read as long as they are tax administrators, agents and owners themselves. After the city village registers in the Taiwan account, carries on the publicity to this.

Subject matter / non-standard fixed assets of amortized assets

Those that must be written on the depreciation asset declaration form shall only be bound by the depreciation asset tax. In order to document and organize documents correctly, it is important to know what is the object of amortized assets and which is other than the object. Let's specifically examine the target assets of the assets.

Target assets of depreciated assets

As the object of depreciation asset tax, there are many aspects of asset division that are difficult to understand, and there are also situations that can not be judged. In order to select objects, it is important to understand the judgment criteria separately.

構築物・建物付属設備

The ancillary equipment of structures and buildings is the object of depreciation asset tax. The main contents of the structure include advertising towers, parking facilities, gates and walls, as well as gardens and greening facilities.

The ancillary equipment of the building includes substation equipment, own power generation equipment, parking equipment and so on. The relationship between buildings and equipment is integrated in many cases, but the object of the depreciated asset is detachable and can be moved to another place. In addition, things set outside also become depreciated assets.

機械及び装置

Opportunities and devices include mechanical parking equipment, machine tools, woodworking machinery and other manufacturing and processing machinery, printing machinery, chemical devices, electric motors, lifting appliances, civil construction machinery and so on. Machinery used in factories, cinema equipment and playground equipment are also included. In addition, self-propelled machinery such as bulldozers and power excavators are also objects of depreciation assets.

船舶・航空機

Ships refer to ships used in small boats, trucks, fishing boats, work ships, hydrofoils and other undertakings known as "ships" and "barges". Aircraft include airplanes, helicopters, gliders and so on.

自動車税対象外の車両及び運搬具

The large special vehicles and all kinds of vehicles stipulated in the Road Transport vehicle Law are the objects of depreciation assets tax. Specifically, there are steam locomotives and trams, as well as fire engines, ambulances, sprinklers, radio propaganda vehicles and so on. Even if it is self-propelled, bulldozers and power excavators need to be noticed because they are regarded as machines and equipment.

工具、器具及び備品

Tools, appliances and equipment include office automation equipment, tables and chairs used in restaurants, kitchen utensils and other types. Specifically, take computers, photocopiers, signboards, air conditioners, network equipment and so on as objects.

In addition, according to different industries, laundries will target washing machines and dryers, printing machines and shredders in the printing industry, and packaging machines and drilling machines in the manufacturing industry.

Fixed assets of non-amortized assets

Not subject to depreciation asset tax, formal and other taxes. It is necessary to be careful not to write non-object things on the depreciation asset return.

無形固定資産

Intangible fixed assets refer to invisible assets. Because it is something without shape, it will not be consumed or damaged over the years. Therefore, the value does not change, there is no need for depreciation, and it does not involve amortization of assets. Specifically, there are patent rights, trademark rights, design rights, software and so on.

営業車両

Business vehicles seem to be the object of depreciation assets, but because they are the object of automobile tax, they will be removed from the object of depreciation asset tax.

土地建物

Because land and buildings are the object of fixed assets tax, they are excluded from the object of depreciation assets tax. The equipment and machinery installed on buildings, which are included in the assessment of fixed asset tax, are not subject to depreciation asset tax.

リースしているもの

Because the owner of the lease is a leasing company, it does not belong to the assets of the firm set up. Except for things leased such as photocopiers, computers, office spare parts, etc., it is necessary to fill in an application for depreciation assets.

What you want to pay attention to.

There are also situations that you want to pay attention to when making depreciation asset returns. In cases where depreciation assets are used as exceptions, please pay attention to the treatment of depreciation assets.

償却資産をほかに賃貸している場合

In the case of an amortized asset leased separately, it is contrary to the aforementioned "leased thing". In the final analysis, the declared amortized asset is the owner of the asset, no matter where it is, if it is owned by the company, it needs to be declared. However, in the case of an exception to the sale and purchase of assets that retain title, the actual owner is the lessee, and the lessee is required to pay tax.

償却資産を共有している場合

In the case of shared amortized assets, it must be declared jointly by all the sharers. After deciding on the representative, record "on behalf of the other 00" in the owner's name column, and fill in the owner's name and holding rate in the remarks column.

20万円未満の固定資産を一括償却した場合

In the "one-time amortization of small assets" that can amortize small fixed assets at one time, there is a special case of amortization of things of more than 100000 yen and less than 200000 yen within three years (36 months). In the case of such "one-time depreciation", the object who rejects the asset declaration can be excluded.

The writing of depreciation asset declaration statement

Once you know the types of assets that need to be declared as depreciated assets, you will actually fill in the depreciation asset declaration form. The preparation of all kinds of information is essential for the production of depreciation asset declaration. Understand the method of declaration and prepare the necessary documents.

Prepare fixed assets ledger and depreciation details, etc.

In order to make depreciation asset declaration, basic information is needed. In the case of a legal person, the account of fixed assets shall be used, and in the case of an individual, the details of depreciation in the income tax return and the account books for the management of fixed assets shall be used. The information that the operator should declare is only the acquisition date and price of the depreciated asset, and does not calculate the tax amount, etc.

There are two ways to declare.

The declaration of amortized assets shall be in written form or electronic form. There are two ways to declare, please choose one of them.

一般方式

The general method refers to the method of declaring assets that have changed in the previous year. The quantity of the type and name of the asset is obtained, and the useful life of the asset is increased (reduced). The reason is copied from the general ledger without calculation.

Only in the first year, you must declare all the depreciated assets held on January 1, but you only need to fill in the increased or subtracted assets after the next year. In the case of handwriting, it is easy to recommend this general method.

電算処理方式

Computerized processing refers to the method of recording all amortized assets owned as of January 1 of the current year. In this case, the operator must calculate the valuation. It is better to use software to manage fixed assets, and depreciation asset declaration forms can also be made with software, but handwritten ones may be more laborious than usual.

List of documents required for amortized asset tax declaration

The documents required to declare amortized asset tax are different after the first year and the second year. According to the situation of our company, prepare all necessary documents and submit them within the time limit.

事業初年度の書類

In the first year of your career, submit two kinds of documents.

Different types of books (for increasing the use of all assets) this book (for increasing the use of all assets) is a document used when assets are + when assets are newly declared in the first year and when new assets increase after the second year. In the case of the first year, do 0 for all assets and write out all assets.

Depreciation asset declaration form (depreciation asset tax ledger) depreciation asset declaration form is a document that summarizes and classifies the total list and declares the status of all assets. Also declare the depreciation method of tax accounting and whether there is a blue declaration and so on.

2年目以降の書類

After the second year, in addition to the category list (used to increase assets and all assets) and the amortized asset return (depreciation assets tax ledger), a category list (used to reduce assets) is also required. The category classification (reduction in asset use) records the decrease in assets in the previous year as a result of sales, etc. Since there are no reduced assets in the first year, it will be needed from the second year.

In the absence of reduced assets, submit without filling in anything.

Deadline for submission of depreciation asset returns, etc.

The deadline for submitting amortized asset returns is January 31 of the current year. Declare the amortized assets owned on January 1 of the year. After the declaration, the prices of the assets are registered in the amortized assets tax ledger, and the accounts may be consulted. If you are not satisfied with the price registered on the account, you may apply for examination within 3 months.

The tax method of depreciation assets tax

Depreciation assets tax is taxed in the form of "taxation". Although individuals or legal persons like fixed assets are not required to declare at all, the calculation of tax does not need taxpayers to do. Explain the method of taxation and tax payment.

Tax calculation and delivery of tax notice

The depreciation asset tax shall be determined by the municipal village according to the date and price of acquisition declared in the depreciation asset declaration form. After the depreciation asset return is submitted, the valuation is registered in the depreciation asset tax ledger and the tax notice is delivered in early June.

Payment of amortized asset tax

The lead time of depreciation asset tax is based on four times a year. In principle, the month of delivery is February of the 12th year, but there are different delivery dates according to the regulations of the municipality, so it is in accordance with the specified delivery time.

In addition to the payment of depreciation assets in public offices, financial institutions and other windows, there are account transfer, Peggy payment, credit card payment. When transferring money, you need to go through the formalities in advance.

Peggy or credit cards may be handled by the municipality or not. If Paige is possible, a marked tax notice will be sent and the payment method will be selected according to the type of payment bill.

Depreciation assets tax exemption point system

Depreciation assets tax has a duty-free shop system. A system in which depreciated assets are not taxed even if the amount is small. The tax exemption point for depreciated assets is 1.5 million yen, and there is no tax if the total amount of depreciated assets is less than 1.5 million yen. However, depreciation assets need to be declared, please note.

Summary (summary)

償却資産申告書は、対象となる資産を持っている事業者が提出するべき書類です。償却資産税の計算に必要なため、毎年提出しなければいけません。償却資産税は固定資産税の一種で、税額の算出や納付書の準備は自治体が行う賦課課税ですが、固定資産税とは違い個々に申告も必要です。書式や期限が決まっているので、期限内に正しく作成し、提出しましょう。

創業手帳冊子版は、資金調達や節税など起業後に必要な情報を掲載しています。無料で届きます。起業間もない時期のサポートにぜひお役立てください。関連記事【保存版】株式会社設立の「全手順」と流れを創業手帳の創業者・大久保が詳しく解説!【保存版】はじめてのNPO法人設立|メリット、設立費用、期間、条件は?(editor: editorial Department of Entrepreneurship Handbook)

このカテゴリでみんなが読んでいる記事 1位税金法人税の申告期限はいつまで? 納付期限や支払時期、支払方法Summary (summary) 2位税金法人税・法人住民税・法人事業税の違い?知っておきたい法人税の基本構造 3位税金役員報酬って変更できるの? 決め方や相場、税金について創業手帳の代表が解説します!

![10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book] 10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/4a18d0792cae58836b71b9f591325261_0.jpeg)

![[Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc. [Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc.](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/c88341f90bab7fe3ce1dc78d8bd6b02d_0.jpeg)