What is the cost of a sole proprietor to open a business?Explains how to use, average amount of money, and how to procure

What is the cost of a sole proprietor when opening a business?What is the amount?I will explain it including the procurement method

When a sole proprietor opens, it is necessary to have a variety of expenses as a funding fund.There are a wide variety of situations where opening funds are paid, and you should calculate the required amount and procure them properly.In addition, the market price of opening funds varies depending on the business, but knowing the average amount of funding funds is one guide.

This time, I will explain the opening funds that the sole proprietors should have.

* In the "Founding Handbook" that writes this article, more fulfilling information is also explained in the thick "Founding Handbook / Printing Version".Please order it because you can get it for free.

Contents of this article

About opening funds

Opening funds are the costs paid when preparing for starting a business.

開業資金は、新しく起こす事業において必要なものを購入したり物件の取得や改装などに支払ったりする費用の全般を指します。

In addition, the cost of working funds for the time being may be counted as opening funds, and it is necessary to prepare a certain amount of money before opening.

Here, I will give you the main use of opening funds.

If you have a business or store, you will pay the property acquisition cost, such as the rent or purchase cost of the tenant.

When the property is obtained, it is necessary to pay not only the cost of the property itself but also the deposit, key money, brokerage fee, etc., so a relatively large amount of expenses is required.

When you want to renovate the interior and exterior of offices and stores with your own image and usability, you need to pay for the renovation.

The amount varies depending on the size of the renovation and the material used, but this cost is relatively large among the opening funds.

If you have an office, you need equipment such as desks, chairs, and shelves.In addition, we want to set up a reception space for visitors and prepare sofas and tables.Even if you have a store, for example, if you are a restaurant, you need to prepare a table or chair, and you have to prepare the cost of purchasing these equipment.

PCs are essential not only for telephone calls to the office, but also for online transactions and materials.As a result, the opening cost of the communication line and the acquisition cost of various devices such as telephone and PC will be charged.

It is desirable that these devices are high -spec high -spec communication plans and devices for business use, not for home use.

・ How to reduce the cost of communication equipment, etc. In order to reduce the acquisition costs as much as possible, it is a good idea to choose a used or slightly dropped one.

Leasing and rental are also effective methods.However, leases and rentals should be carefully checked about monthly running costs and contracts.

In order to make the new business informed to customers and business partners, it must be advertised in several ways.For that reason, we will create a website and flyer, but if you ask an expert for design and operation, we will prepare that reward.

In addition, it is a tool creation for advertising that the cost of the website operation, the printing costs for flyers, etc. are surprisingly expensive.

・ In order to reduce advertising costs, in order to reduce advertising costs such as websites and flyers, it is one way to avoid outsourcing designs and operations.

In particular, there are many sites where you can create a homepage with some desired designs with simple and intuitive operations.Use such services well and consider reducing advertising costs as much as possible.

In order to calculate opening funds from the costs required for opening these businesses, we will consider whether the expenses are necessary for the profits obtained in future business results.For example, if you expect a small profit to get on the track in the first year, you may not have to buy a large -scale equipment.

In addition, as mentioned above, communication devices are often used, leasing, and rentals.

In this way, considering which part can be reduced, decide the part you want to spend.If the total amount is reduced the cost effect, it is necessary to further review the opening funds.

In addition to opening funds, working funds should be prepared

Opening funds are the costs required for opening a business, but when opening a business, you should also prepare for the immediate working capital.

Driving funds can be said to be the running costs for continuing business.

For example, even if sales occur with a customer, if you are receiving receivables, the sales will be deposited about one to two months.In the meantime, you must pay the purchase of products and raw materials, as well as the rent, utility expenses, and communication expenses of the office.

If there is no payment of sales and there is no money during the expense period, the business is likely to tilt at that point.For this reason, it is necessary to prepare working funds properly separately from the opening of the business, understand the flow of cash, and make good financing.

In order to calculate the amount to be prepared as a working fund, it is necessary to consider the following amount of money based on the profit expected through the business plan.

Account receivable is the amount to be collected from the business partner, and the inventory is to get future sales.

On the other hand, if you deduct the accounts payable to the business partner, you can calculate the amount that can be used for running costs in the business.In order to prepare enough working funds to cover running costs, calculate the above three amounts.

As a general measure of working funds, it is good to consider running costs for the next three months after opening.

This is assumed that even if the sales will be recovered in three months, it will be possible to collect it in three months, and if there is a deposit before the working capital reaches the bottom, you can make a stable cash flow.In other words, the working funds to be prepared at the time of opening should be prepared in anticipation of the time of accounts receivable.

About the treatment of opening funds

Opening funds are all expenses to be prepared for opening, and many things are treated as an account "opening fee" in accounting.

However, it is important to note that there are certain conditions for what can be recorded as a opening cost, and whether it is recognized as expenses.

It is assumed that the cost of opening the opening is the cost of the cost before opening, and the following is mainly the following.

On the other hand, some of the costs paid before opening cannot be recorded as a opening fee.

・ Remodeling expenses and exterior renovation costs are considered to be repaired as repair costs for continuing business or repairs for continuing business, but will not be recorded as opening expenses.

・ The cost of purchasing products and raw materials is assumed that the business will be provided and provided as a product or service, and it will be sold after opening.Therefore, it is recorded as a cost of sales, not the opening fee.

・ When renting a rental property deposit or key money office, no deposit or key money paid at the time of moving in is not included in the opening fee.This is because the security deposit is returned after leaving, and the key money is considered as part of the rent.

-The cost of a relatively large cost, such as PCs, printers, and copy machines, such as equipment with a price of 100,000 yen or more, the cost exceeding 100,000 yen is not open.In this case, it is a fixed asset to be used for a long time, and it is necessary to gradually be deprecated as expenses every year according to the service life of the equipment.

* Differences in the handling of sole proprietors and corporations, even if they are recognized by sole proprietors, they must not be recognized by corporations and must be recorded.The cost of opening a corporation is only for the special expenses for the opening of the business.

The general business opening fee recognized by sole proprietors is considered to be paid constantly in business management, and is often not included in the opening cost.

Opening funds are different depending on whether the payment is paid before or after opening.

Before opening, the opening expenses for various things are considered as deferred assets because they are determined to be necessary in developing businesses.And all of the expenses that can be opened must be recorded as deferred assets, and we need to be deprecated every year as in fixed assets.

In order to amortize the opening costs as deferred assets, the handling of the tax law is slightly different.In accounting processing, we will be equally amortized over five years.On the other hand, voluntary amortization is possible under the tax law.

・ Averaging is a method of dividing the opening fee equally for the depreciation and depreciation of the same amount.

-The voluntary amortization can be determined by determining the amount to be paid as depreciation expenses between 0 yen and the amount of opening expenses.In other words, it is also possible to reduce the depreciation costs and amortize in a year when sales are small and have a large surplus.

On the other hand, if expenditures such as buying equipment after opening or spending money on advertising, it will be recorded as expenses such as consumables and advertising expenses.In other words, even if expenditure is open, it will be treated as the same as normal expenses in business management.

Thus, before and after opening, you need to be careful because there are differences in accounting processing.It is important to separate the receipt of the expenses spent when opening a business before and after opening.

About the average value of opening funds

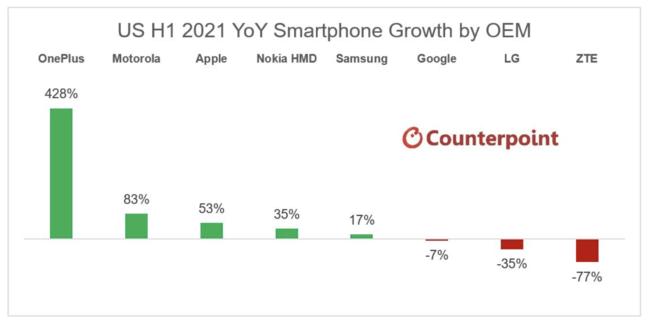

Depending on the type of business that opens, the cost of opening a business is wide, but there are data that gives the approximate average value.

According to a survey in FY2020, the average opening funds spent by the newly opened people is about 9.89 million yen.This figure has been gently descending since 1991.

One of the reasons why the average value of opening funds is on a decline is that it has become a relatively small -scale opening, and the number of ways to open inexpensive due to franchises has increased.

As described above, data indicating that more people are opening with relatively small funds is that the proportion of less than 5 million yen is gradually increasing.The percentage of people who opened for less than 5 million yen is about twice in 2020 compared to 1991.From this result, it can be said that the opportunity to start a business with a small amount of money has increased.

How to procure opening funds

From here, I will give you the main procurement method of opening funds.

・ It is a form that invests self -funds from your own savings that generate your own funds and invest in your business.

・ If the employee has an employee shareholding association that owns the company's shares, the company will be able to receive investment from employees.

・ A stock company that is invested from other companies transfers its own shares to other companies and receives investment.

・ Venture capital, which is invested in venture capital, is an investor who invests in venture companies that can grow in the future, and many are made on a company -by -company.

・ Angel investors who are investing in angel investors are investors who invest in individual basis and investigate growth.

・ It is a system that allows you to post your own business on the Internet site that raises funds by crowdfunding, and get funds from a general individual with sympathy.

・ Banks, which make a loan for individuals at banks, sell individual loans for funding for opening a business.For individuals, it is possible to borrow with personal trust, even if there is no company's track record.

・ As a closer method of borrowing from relatives and acquaintances, we sometimes borrow funds from relatives and acquaintances.However, in this case, you need to be careful about financial troubles.

・ If you receive a loan from a financial institution that receives a loan using a guarantee from the credit guarantee association, it is a method of making it easier to borrow by receiving a guarantee by the credit guarantee company examination.

・ Before opening a business from a bank as a business owner, the business owner may seem to have a high hurdle because of the lack of achievements.However, if you have a specific vision, such as submitting a business plan, you may be able to get a consultation.

・ In the case of Shinkin Bank, not a major bank that receives a loan from Shinkin Bank as a business owner, there are some places that actively support the business owner before opening.For this reason, many measures are prepared for business owners.

・ The Japan Finance Corporation, which receives a loan from the Japan Finance Corporation, has a variety of systems to support business owners.There is a screening for loans, but the hurdle of application conditions is relatively low.

・ This is a system that allows you to receive a loan from the Japan Finance Corporation and low -interest rates by receiving a recommendation at the Chamber of Commerce and Industry in the area where you receive a loan by receiving the recommendation of the Chamber of Commerce and Industry (Maru Loan).

・ Various subsidies, subsidies and local governments have a subsidy and subsidy system for opening a business.It is a method that does not generate interest rates and makes it easier to fund.

・ Reemployment allowance If you are hired by the company before opening, you can receive the allowance when you re -employ (open) by the employment insurance system.

As described above, there are many ways to procure opening funds.However, there is no way to prepare for some self -funds.If you know that you have your own funds, you can easily get trust from financial institutions, and, above all, you will be less expensive.

If you are thinking about opening a business, we recommend that you start with your own funding.

summary

There are a variety of expenses for opening a business, so you should first list what you need and calculate the total of the opening funds.It is important to note that in accounting, it is divided into those that do not become deferred assets as expenses for opening a business, and those that are recorded as regular expenses due to expenditures after opening.

There are various ways to raise business funds, so choose something suitable with your own funds.

創業手帳の冊子版(無料)は、開業にかかる費用の概要や会計処理方法、資金調達方法などについて詳しく解説しています。開業をお考えの方は、ぜひ参考にしてください。関連記事開業資金を集めるにはどうすればいい?知っておきたい制度や手法をsummaryました開業資金調達に!融資審査の通る確率が格段に上がる4つの対策(Edit: Founding Handbook Editorial Department)

このカテゴリでみんなが読んでいる記事 1位資金繰り【経営者必見!】いま使える新型コロナ支援制度をsummaryました~活用例もご紹介 2位資金繰り事業計画書とは?4つのメリットや注意点、書き方解説!事業計画書は起業や資金調達の成功ポイント 3位資金繰り小規模企業共済とは?危ない?加入資格から解約方法、メリット・デメリットまで解説!

![10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book] 10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/4a18d0792cae58836b71b9f591325261_0.jpeg)

![[Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc. [Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc.](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/c88341f90bab7fe3ce1dc78d8bd6b02d_0.jpeg)