Intensifying Telecommunications Industry Trends and Future Prospects

Contents

■<Changes in the telecommunications industry in 2021■<Current status of share of 4 carriers■

Changes in the telecommunications industry in 2021

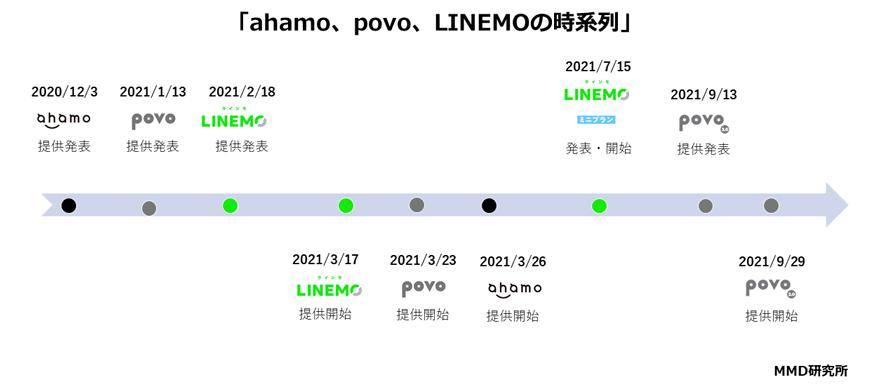

In 2018, then-Chief Cabinet Secretary Suga said that there was room to reduce mobile phone charges by about 40%. In response to the request of "price reduction", each company reduced the price plan all at once. In response to the request, the three major carriers will develop services that can be applied for online (online) such as ahamo, povo, and LINEMO in 2021, and are developing unprecedented low-priced plans. In April 2020, Rakuten Mobile entered the market as a fourth carrier, and a new movement was seen in the industry.

The MMD Research Institute conducted a "December 2021 Telecommunications Service Usage Trend Survey" to follow user trends as seen from trends in the telecommunications industry. In this column, we will look at the current state of the telecommunications industry, which has undergone drastic changes in terms of the market share of telecommunications services and the intentions of users to switch/change plans in the future.

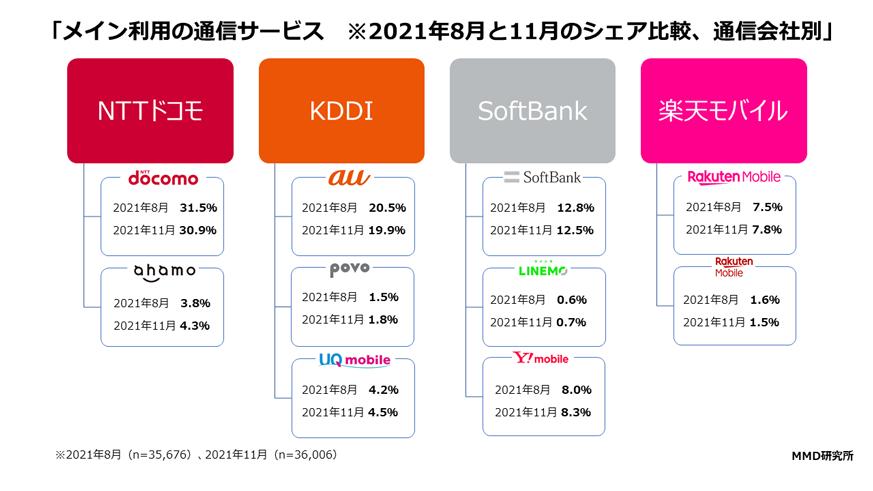

First, let's take a look at the market share of telecommunications companies in December 2021. When we asked 36,006 men and women between the ages of 18 and 69 who own a smartphone with a communication contract about their main smartphone communication service, the four carriers were "docomo (30.9%)" and "au (19.9%)”, “SoftBank (12.5%)” and “Rakuten UN-LIMIT VI (7.8%)” for a combined total of 71.0%. Looking at online-only plans, "ahamo (4.3%)", "povo (1.8%)" and "LINEMO (0.7%)" have a share of 6.8%, and the carrier sub-brands "Y!mobile (8.3%)" and " UQ mobile (4.5%)” was 12.8%, and “MVNO” was 9.3%.

Compared to a similar survey in August 2021, NTT Docomo remained unchanged from August, KDDI decreased by 0.1 points, SoftBank increased by 0.1 points, and Rakuten Mobile increased by 0.2 points. Looking at the services by service, the share of the three major carriers' main units is decreasing, but online-only plans and sub-brands, which are communication services related to our company, are growing. Similarly, “Rakuten UN-LIMIT Ⅵ” is steadily increasing its share, and it is the only one among the four carriers whose main plan share has turned positive. Based on the results from here, let's look at the details along with the movements of each company.

Current state of share of the four carriers

First, let's look at the situation of each company from the announcement of the financial results for the first half of the four major companies. At the financial results announcement on November 10, 2021, NTT DoCoMo's first-half sales were 2,316.2 billion yen, and operating income was 496.3 billion yen, a decrease of 67.3 billion yen. KDDI will announce its financial results on October 29, 2021, with sales in the first half of 2,625.2 billion yen, an increase in sales and an operating profit of 573.1 billion yen, and SoftBank will announce its financial results on November 4, 2021. Operating income was 570.8 billion yen, while sales were 2,724.2 billion yen. According to the Rakuten Group's announcement on November 11, 2021, revenue increased by 12.6% year-on-year in double digits due to the strong growth of domestic e-commerce sites such as Rakuten Ichiba and Rakuten Seiyu Net Super. Looking at the figures, while net sales were 54.9 billion yen, operating revenue ended at minus 105.2 billion yen. Rakuten Mobile is currently in the red due to network construction costs, etc., while there are users who are still applying the one-year free campaign.

・NTT DOCOMO In 2020, NTT DOCOMO became a wholly owned subsidiary of NTT, but on December 14, 2021, based on the new DOCOMO Group medium-term strategy announced in October, we will reorganize the organization among group companies. It has been announced that it will be implemented around July 2022. Among them, the biggest change is that it will be possible to contract for economy MVNO fee service at docomo shops nationwide announced in October 2021. Although the contract will be an MVNO, you can use a cheap SIM service using the docomo line at a low price. Furthermore, being able to make a contract at a familiar docomo shop is considered to be a material for considering MVNO even for users who have never used MVNO in the past. Docomo already has a Gigalight plan that charges only for the amount used, but it is a pay-as-you-go system from 1GB to 7GB, and the price is 2,178 yen (including tax) even if discounts such as docomo Hikari set discount are applied, which is economical. It will be higher than the price range of MVNO. According to the "December 2021 survey on communication service charges and capacity", more than half of the monthly data capacity of smartphones recently used by major 3 carrier users is small (1GB or less to 7GB). , Isn't there a lot of users who are looking for a small capacity? Docomo does not have a carrier sub-brand, but I think the key to the future will be to acquire users who do not use videos and games from economy MVNOs and who want to reduce communication costs.

・KDDI povo, which started on March 23, 2021, was updated to povo 2.0 on September 29, 2021. Unlike the conventional povo 1.0 one plan, povo 2.0 is a complete customization method in which you add data toppings and call toppings to the basic charge of 0 yen. To continue the contract, you need to use some paid toppings once every 180 days. Depending on the amount of data purchased, there is a time limit for data toppings, but you can choose from 5 levels from 1GB to 150GB, and you can easily purchase from the app according to the month you want to use. At the time of the povo 2.0 launch on September 13, 2021, the number of povo contracts was disclosed to be about 900,000, but at the time of the announcement on October 29, 2021, it was announced that it exceeded 1 million. it was done. With 100,000 subscribers acquired in about a month and a half, the concept of "together with the perfect freedom for you." It is thought that it may have become a fortress to prevent outflow.

・SoftBankSoftBank has set "Beyond Carrier" as a growth strategy since 2017, providing services in various industrial fields including PayPay, and moving beyond the boundaries of traditional telecommunications carriers. We are strengthening. On the other hand, LINEMO, an online-only plan that was launched at the same time as NTT Docomo and KDDI, only disclosed the number of contracts combined with LINE MOBILE even when the financial results were announced in November. It seems to be forced. On July 15, LINEMO launched a 3GB 990 yen (tax included) mini plan, the first online plan to offer a plan other than 20GB. At first glance, it may seem like a novelty, but Y!mobile, a member of the same group, already covers small capacity, and contracts can be made at stores. The family discount makes it possible to use the plan at the same price as the mini plan, so I feel that the contract threshold is higher than Y!mobile. At the press conference on September 14th regarding new services, Y!mobile has continued to perform well, surpassing 7 million subscribers, a 124% increase compared to the previous year. Also, on December 2nd, SoftBank announced the provision of a time-based unlimited giga option as an option for the 3GB data communication plan. Although the number of users has not increased sharply, judging from the strong performance of Y!

・Rakuten Mobile Officially announced the service as an MNO in March 2020, and it has also attracted attention for its simple and easy-to-understand one-plan. A total of 5.1 million contracts were announced. The number of subscribers surged from February to April of the same year due to rush demand following the end of the one-year free campaign, but the number of users is steadily increasing. In this market share survey, when asked about the telecommunications company they used before signing a contract with the telecommunications company they are currently using, about half of the Rakuten UN-LIMIT Ⅵ were from MVNOs (including Rakuten Mobile's MVNO). Although it is an influx, it turns out that each of the three major carriers has acquired about 10% of users. However, the number of base stations increased significantly from 17,564 in March 2021 to 30,055 as of November 2021, and revenue did not increase due to the enormous cost of capital investment. Since the company has switched its roaming area to its own line ahead of schedule, it should be possible for Rakuten Mobile to regain momentum through future user acquisition and cost reduction.

What is the position of MVNOs in the midst of fierce competition?

Let's take a look at the MVNO situation. As mentioned at the beginning of the communication service share situation, the result of this survey shows that the share of MVNO is 9.3%, which is less than 10%. Looking at the changes in the utilization rate from October 2014, the share increased year by year until 2019, reaching 13.2%, but in November 2020, it decreased by 0.9 points to 12.3%, and in November 2021. In January, the result was a further 3.0 point decrease.

Recently, MVNO operators have announced new rate plans to compete with new plans announced by major carriers such as ahamo, povo, and LINEMO. In January, the Telecom Service Association MVNO Committee submitted a request to the Ministry of Internal Affairs and Communications, and in February, the Ministry of Internal Affairs and Communications issued a request to a major carrier. It's halved. As a result, the MVNO market has been able to take countermeasures, and is launching new plans one after another. However, the market share is declining year by year, and it is thought that the MVNO market is entering a severe ice age.

As a major factor in this share phenomenon, it is considered that the impact of Rakuten Mobile's pay-as-you-go plan starting from 0 yen is large. As mentioned earlier, more than half of the telecommunications companies that Rakuten Mobile users used to use before are MVNO users. The most common reason for considering a plan change or transfer was "because the price is cheap", and while there are many users who are based on the price, it is thought that Rakuten Mobile's one-year plan fee free campaign has leaked out.

In that case, there may be a certain number of users who return to MVNO after Rakuten Mobile's one-year free campaign ends. Rakuten Mobile is rapidly increasing the number of contracts from February to April 2021, and the latest subscribers will be eligible for the campaign until April 30 this year. Due to the outflow of users after the end of the campaign, it seems that the share of MVNOs can be expected to increase.

Isn't there one thing that MVNOs can't afford to lose to price competition in order to acquire users for their company when they flow out from Rakuten Mobile?

Summary: Considering the future of MNO and MVNO

Major carriers are steadily acquiring users little by little with new plans and sub-brands, and are also covering users who value low prices. In particular, Rakuten Mobile is among the top destinations for users of the three major companies to consider switching to, and from the perspective of the three major companies, it may be a carrier that should be noted. However, although the sub-use of Rakuten Mobile is increasing considerably, the key to the future will be how many prospective users will be acquired without losing users who are applying the one-year free campaign.

On September 21, 2021, NTT DoCoMo announced that it would abolish the cancellation fee, and on December 23, 2021, the contract cancellation fee for au and UQ mobile will be abolished on March 31, 2022. Announcement, SoftBank announced on October 26, 2021 that it will be abolished in February 2022, making it easier for users to change careers and plans that suit their lifestyles. In the market as a whole, Rakuten Mobile currently has a pay-as-you-go plan, and povo provided by KDDI can also purchase giga and pay data communication charges according to their own lifestyle. In the future, when you want to change the communication volume according to your living situation, there will be an increase in pay-as-you-go plans and plans like povo that you can customize depending on the time, without the hassle of changing plans or switching. . When this happens, the adverse effects may be that it may be difficult to understand the difference from other companies, and customization may become complicated. The key will be how to convey the plan to users in an easy-to-understand manner like Rakuten UN-LIMIT.

The MMD Research Institute will continue to investigate the subscriber status of telecommunications companies.

If you have any questions about the survey data, please feel free to contact us using the inquiry form below.

*Since this survey report is written with any number of digits after the decimal point rounded off, an error may occur when the figures are added up. * Respondent attributes can be checked from the free report after registering as a member.

If you have any questions about the above research, please contact us using the inquiry form.

≪Usage of this research report≫ As a general rule, please refrain from reprinting without permission the documents on the website that MMD Research Institute has released free of charge and their contents. Whether or not the data can be used or quoted depends on the content of the data, so please first contact us by e-mail describing the scope of publication, use/purpose, media, etc. The person in charge will contact you later. Secondary use of copyrighted works is permitted without separate permission if all of the following conditions are met.

*Please contact us if you are a company that would like to be used for sales promotion.

![10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book] 10th generation Core i5 equipped 9.5h drive mobile notebook is on sale at 50,000 yen level [Cool by Evo Book]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/4a18d0792cae58836b71b9f591325261_0.jpeg)

![[Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc. [Amazon time sale in progress! ] 64GB microSD card of 1,266 yen and wireless earphone with noise canceling function of 52% off, etc.](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_9/2022/3/9/c88341f90bab7fe3ce1dc78d8bd6b02d_0.jpeg)